The Creator’s Path to Financial Independence: Part 2 ‘You're Earning Too Much!’

Welcome to the second edition of "The Creator's Path to Financial Independence." If you are new to C&C check out the Start Here section to learn about the hallmarks and traits of consumers and creators. In this edition, we talk about what spending does to our happiness and how creators approach this problem. So, let's start with an age old question...

Does money make us happy?

People who have a lot of money will often say

‘No’ and people who don’t have a lot of money will say often say ‘Yes’. So who’s right? Turns out, both are right, at

least according to a study performed at Princeton University a few years ago

(1).

The study shows that things like

“feeling stress free” and “emotional wellbeing” rise steadily as household

income increase. Yet, something

interesting happens to the data around the $57,000 household income level (2).

After about $57,000, more money did not

make people significantly happier. In fact, in some

areas, stress levels actually rose at higher incomes.

Now, chances are that you make (or

have the ability to make) more than $57,000 a year as a household. In fact, the average household income in 2016 was $74,664 (3). That’s $17,664 of new cars and gadgets that you don't need and that can only add to your stress. So what do you do with this extra cash so that

it doesn’t stress you out?

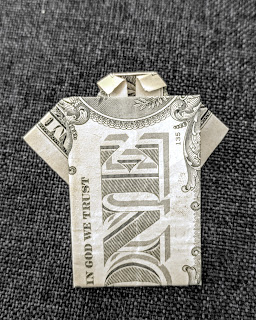

Option 1 – Origami: There are tons of fabulous little creations you can make with excess money! See, I made a sweet little dollar t-shirt, above. Think about all the awesome little creations you could make with your $17,664!

Option 2 - Buy Financial Freedom: Another option is to put it into a

tax sheltered saving account (4).

In fact, using the 25x rule introduced

in Part 1, a modest index fund yielding 8% has you completely financially

independent in 25 years just by saving this excess! And if your company matches your 401k at a 3%

rate, you can shave another year off of that. Take a look at the chart below that compares the

creator’s approach of saving money to the less happy consumer saving the

standard average American 5% of his salary. Again, we see that the creator's life of simply pursuing happiness always outpaces those who try to buy happiness.

But can you really get your cost of

living down that much? Yes! I’m working

now on writing up some practical how’s, but in the mean time feel free to share your ideas below!

(1) https://wws.princeton.edu/sites/default/files/content/docs/news/Happiness_Money_Summary.pdf : Note that the author views the curves reaching diminishing returns later than my assessment of the data.

(2) I adjusted for inflation since the study was dated 2010, otherwise I kept everything in 2018 dollars for simplicity.

(4) I will put up a post on savings and investing soon

Comments

Post a Comment