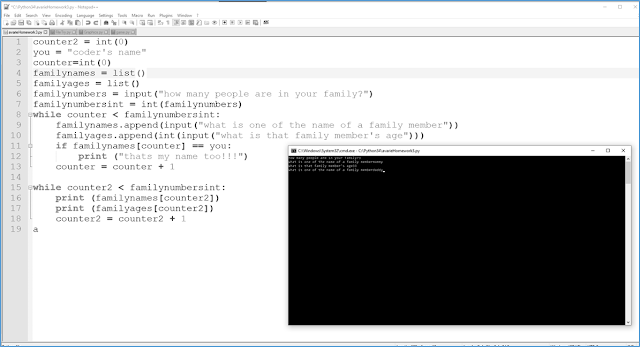

Why I’m Teaching My 7-Year-Old Daughter to Program in Python

There have been a lot of positive events in my life that I can attribute to my dad, but certainly one of the most memorable was the day he brought home our first computer. It was one of the first IBM PCs and included a monochrome monitor. There wasn’t even a mouse. I was probably five years old and remember clearly the sound of it booting up (which took five minutes or so) and the smell of hot circuitry that blew from its vent ports. I explored on it constantly. Eventually at the ripe old age of nine, I saved up enough birthday and Christmas money to buy a used IBM PS-2 of my own which I proudly kept on a desk in my room. This was, of course, perfectly safe for a young man in the early 90's since it was still years before folks in Appalachia knew about the internet. So, what on earth does a nine-year-old boy do with a computer without internet? Well, I had a few games, MS Paint, and an encyclopedia, but I was still curious. I remember my dad walking in one